Mortgage x extra payment calculator

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Formula to Calculate Mortgage Payment in Excel.

. Lets say for example you want to pay an extra 50 a month. Total of 360 Mortgage Payments. This Excel loan calculator template makes it.

It considers the loan amount the annual rate of interest and the repayment frequency for calculation. Estimate your monthly payment with our free mortgage calculator and apply today. But if you reduce your LTV to 80 upon remortgaging you can obtain a 5-year fixed mortgage with 197 APR.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Using the 250000 example above enter 50 in the monthly principal. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete.

Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly. Once you have typed in these numbers hit enter to get your monthly payment. The calculator lets you find out how your monthly.

Like many other excel mortgage calculator Mortgage Calculator A mortgage calculator is used to compute the value of the monthly installment payable by the borrower on the mortgage loan. Say you have a 30-year mortgage mortgage calculator and youd spend a total of 164813 in interest over the life of the loan. In 2022 a 20 down payment is desirable mostly because if your down payment is less than 20 you are required to take out private mortgage insurance PMI making your monthly payments higher.

Calculate loan payment payoff time balloon interest rate even negative amortizations. Making payments every other week and being prepared for that occasional extra payment can be good financial discipline and eventually free up your money for other purposes. Article Summary X.

Using the Bi-weekly Payments for an Auto Loan Calculator. Amount of the principal loan balance the interest rate the home loan term and the month and year the loan begins. You will be prompted to input your monthly interest rate the number of payments during the loan period and the principal on your loan.

The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. With 52 weeks in a year this approach results in 26 half payments. Based on the example the 5-year fixed mortgage with the highest rate is offered to borrowers with 90 LTV which is 305 APR.

1 866 934-7283 Phone Call. There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of. Lets take a look at an example.

The number of years t you have to. To calculate what your mortgage payments will be type the payment or PMT function into a spreadsheet. Adjust down payment interest insurance and more to start budgeting for your new home.

Read more we also have. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Extra Payment Mortgage Calculator.

This mortgage calculator will show the Private Mortgage Insurance PMI payment that may be required in addition to the monthly PITI payment. Mortgage calculator with graphs amortization tables overpayments and PMI. For example lets say youre considering purchasing a 250000 home and putting 20 percent down.

Loan Sep-11-2022 Payment 1 95483 66667 28816 66667 Oct-11-2022 Payment. Now lets say that youre. Log in Log in.

This is the cost of the home minus the down payment. This entails paying half of the regular mortgage payment every two weeks. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

You can also refinance to a shorter-term mortgage which will raise your monthly payments in exchange for a home loan that you can pay off faster. Start by entering the mortgage amount. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then.

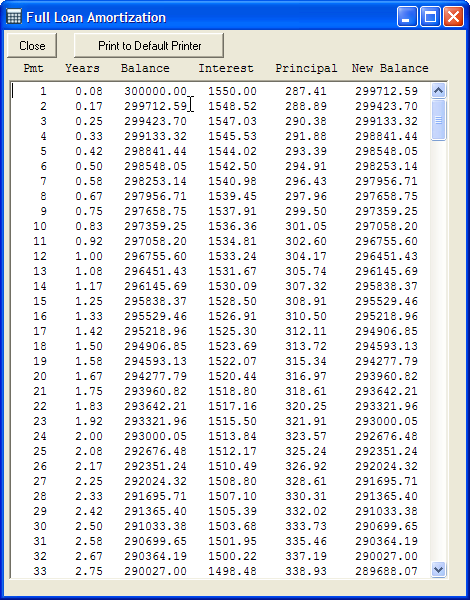

Generate a loan amortization schedule based on the details you specify with this handy accessible loan calculator template. Almost any data field on this form may be calculated. Brets mortgageloan amortization schedule calculator.

Our advanced mortgage payment calculator with PMI multiple extra payments tax and insurance has all the variables built in so that you can estimate exactly how much you will be paying each month. Mortgage Calculator With PMI is a mortgage amortization calculator that has an option to include Private Mortgage. For example you could make biweekly payments or one extra lump sum payment per year.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. This Excel loan calculator template makes it easy to enter the interest rate loan amount and loan period and see what your monthly principal and interest payments will be. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per.

The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment. In addition to the standard mortgage calculator this page lets you access more than 100 other financial.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

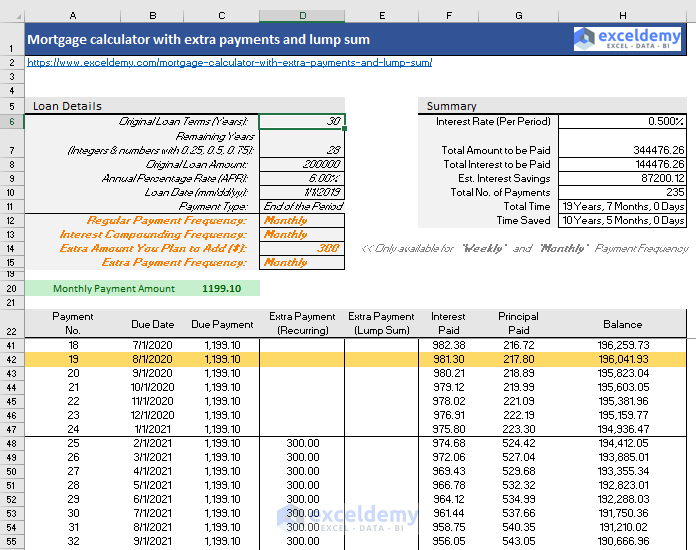

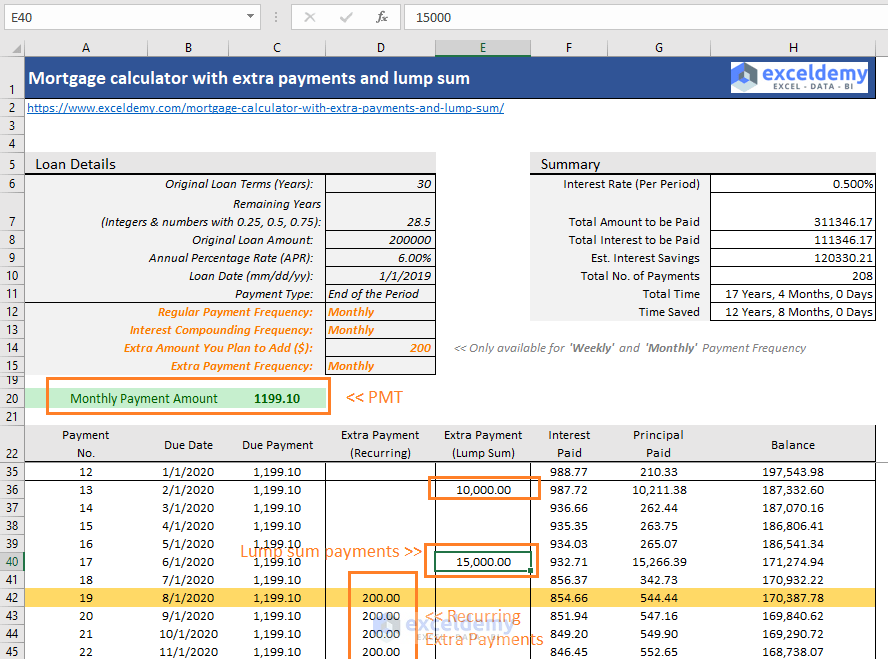

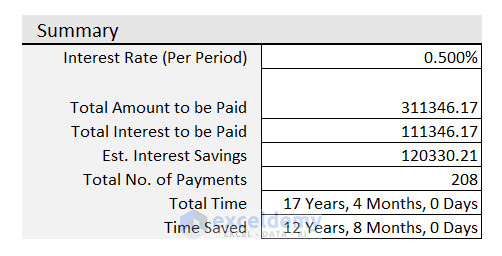

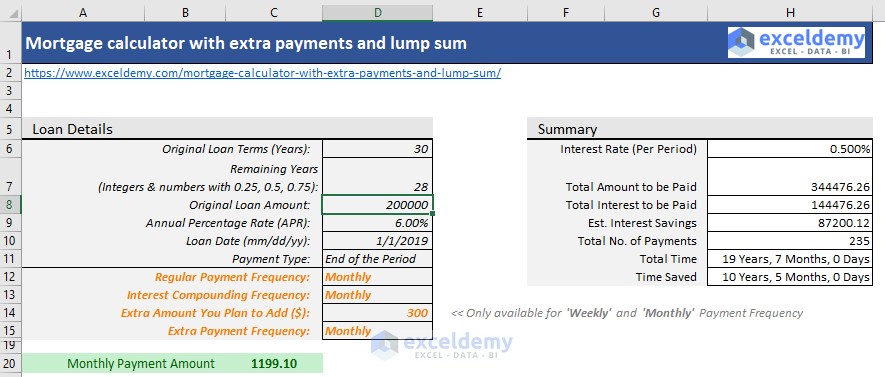

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator Apps On Google Play

Downloadable Free Mortgage Calculator Tool

Extra Payment Mortgage Calculator For Excel

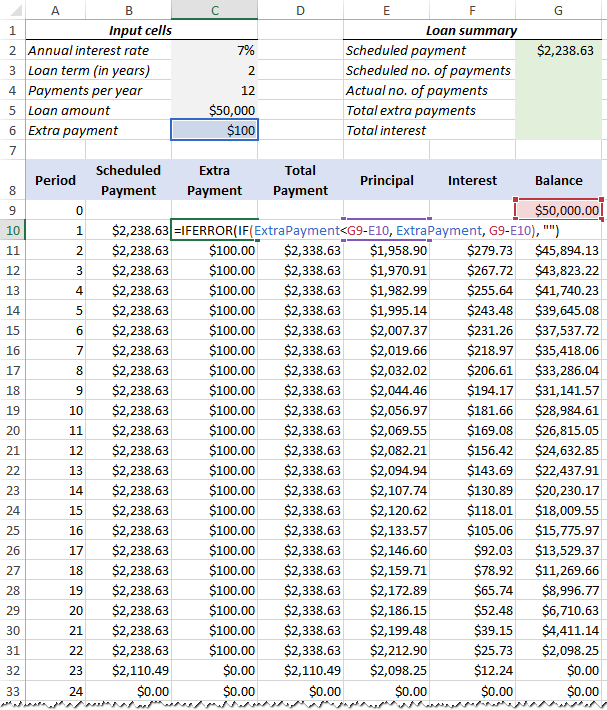

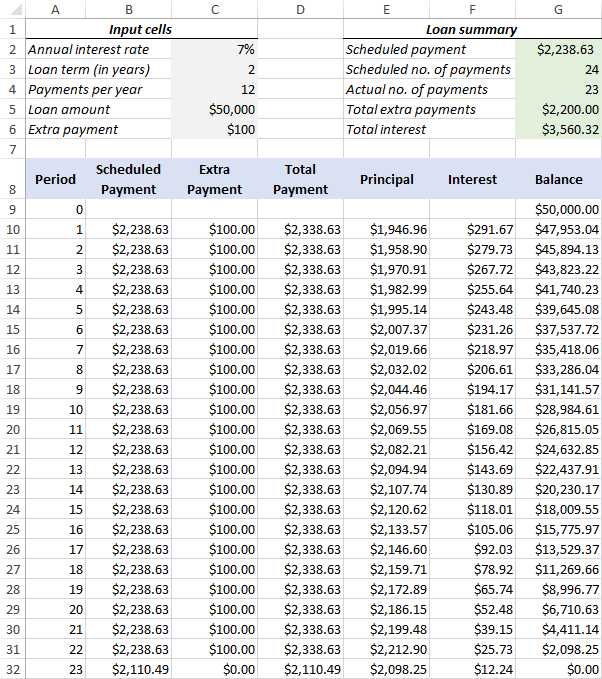

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

/amortizationschedule_definition_final_0804-4e9f8d46da6148d5b68ecb4acaf88c8d.png)

What Is An Amortization Schedule How To Calculate With Formula

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Downloadable Free Mortgage Calculator Tool

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments